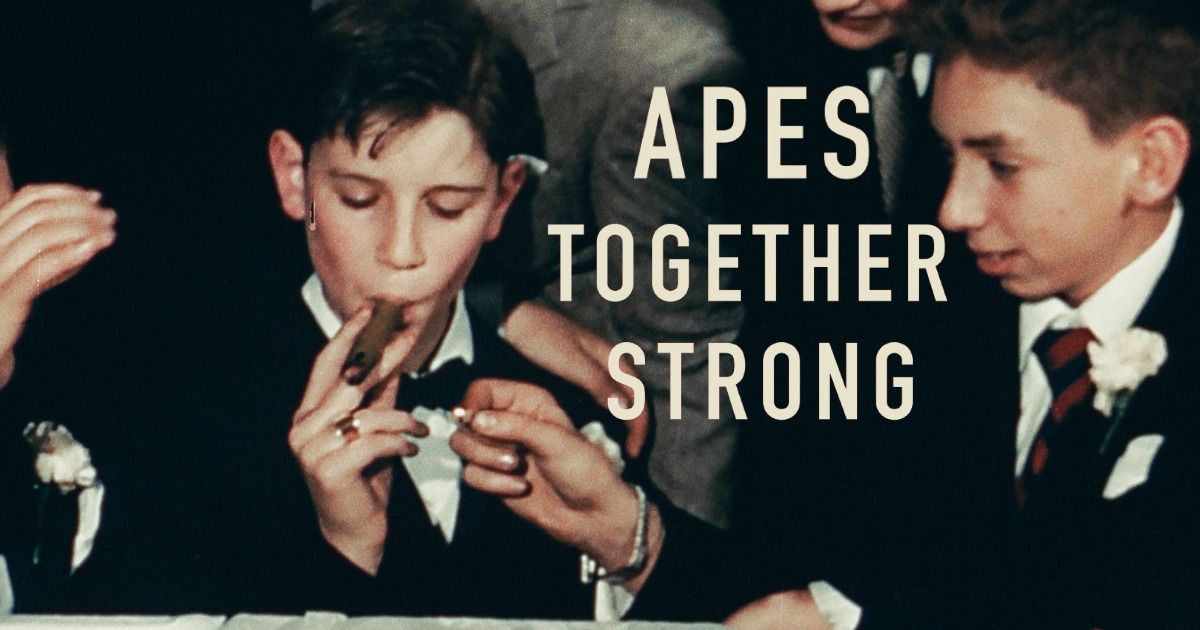

Apes Together Strong, the new film by The Mulligan Brothers, sounds like the next sequel in the Planet of the Apes film series. Sadly, it doesn’t feature Andy Serkis in a motion capture role, and has nothing to do with Earth getting overrun by hyper-intelligent apes that uproot civilization…

Wait a second. Or does it?

Back in 2021, a group of users on Reddit led by YouTuber Kieth Gill/Roaring Kitty, invested their money in the failing video game retailer, GameStop. Gill had spent the preceding months bucking the prediction that GameStop would soon collapse, and managed to parlay a $53,000 investment into a yield of $43 million.

One of Reddit’s stock market and investment groups, colloquially known as “apes,” decided to follow Gill’s lead, less as an opportunity to make money than as a way to highlight how a deregulated financial market designed to bilk investors out of their money couldn’t make good on guarantees to pay out potential profits.

MOVIEWEB VIDEO OF THE DAYSCROLL TO CONTINUE WITH CONTENT

GameStop and Short Sells

See, under Presidents Reagan, Clinton, and George W. Bush, the financial market cast off the protections Congress put in place to prevent another Great Depression, such as the Glass-Steagall Act. By 2021, a number of short-selling broker companies — primarily Robin Hood — could sell and trade stocks they didn’t necessarily own, and do so legally. The positions of such companies bet on a stock declining in value, thereby making a profit off the transaction.

Confused yet? Apes Together Strong provides this example: a short seller (a company like Robin Hood) borrows a bag of sugar from a neighbor, and sells it to someone else for $10. If the value of the sugar drops to, say, $5, the short seller then buys the sugar at the new market price and returns it to his neighbor, thus making $5 in the process. Of course, this business model only works if the price of the stock (here, the sugar) goes down. If it rises, the short seller has to make up the difference to buy sugar to return to the original owner.

Related: 25 Best Documentary Movies of 2022, Ranked

Working on that principle, in January 2021 the titular apes of Apes Together Strong began buying stock in GameStop as well as a company ravaged by the COVID-19 pandemic, AMC Theaters. The sudden rush to buy pushed the stock prices ever higher, thus forcing the short sellers to make up the difference in cost. The problem: Robin Hood didn’t have the capital to make up for the increase in stock prices, and the investment and hedge funds that bankrolled the company, such as Citadel, drew increasing losses. Unwilling to pay back investors, the app blocked buying of GameStop and AMC stocks, essentially fixing the market to make sure shareholders sold off their stock, and that the price of shares dropped.

In other words, when the apes found a flaw in the system designed to benefit big money interests and turn a profit, the big money interests changed the rules of the game.

Evolved Apes

Inner Station

If all this sounds complicated, it is. The Mulligan Brothers make it clear early on in Apes Together Strong that they made the film because major news media underreported the story. The prime forces in the GameStop affair are complex, and given the basic instruction needed to understand the story, most outlets glossed over the “short squeeze.” (Though the movie doesn’t make a point of mentioning it, the events of the January 6 Insurrection — which transpired around the same time — also overshadowed the GameStop balance sheets.)

Thus, the Mulligans craft a film in the vein of Adam McKay’s The Big Short, the film that used non-sequitur humor and celebrity cameos to explain the Financial Meltdown of 2008. Set to a synth wave score and featuring extended interviews with financial analysts and a number of the “apes” that precipitated the GameStop short squeeze, Apes Together Strong offers a play-by-play of events during the affair.

The Mulligans — a set of real life twins — also play out several comedy sketches, going so far as to dress in drag to make the minutiae of the current financial system and broker companies digestible. The result highlights a financial system gutted of any real regulation and unequipped to deal with a world in which investors can buy and sell stocks simply by pressing a button on their phones.

Craven New World

Inner Station

Much of Apes Together Strong also profiles the connections between the financial institutions and services companies, and how, in essence, they stand to gain higher profits by making sure stock prices drop. The most disturbing moment in the film arrives when the online stock retail companies — Robin Hood, Ameritrade, E-Trade, etc. — decide to block sales of GameStop stocks to push shareholders to sell off their shares, forcing the stock price to drop. That action, along with increasing questions about the legality of the Citadel-Robin Hood relationships, has sparked an outbreak of lawsuits, most of which the courts have yet to resolve.

Related: These Great Documentaries Explain Complex Subjects in Understandable Ways

Apes Together Strong and the Mulligan Brothers do a fine job explaining the dynamics of the financial system that allowed the GameStop short squeeze to happen and the noble motives of the investors that caused it. The movie’s biggest problem may be that it actually arrived too soon: though the Mulligans do their best to bring the film to a conclusion, it doesn’t really have an ending. Ultimately, participants weep and talk about investing in a brighter future and analysts note how digital stock traders have an incentive to make sure investors lose money over a montage of drone and YouTube footage.

Beyond a Cliffhanger

Inner Station

None of this brings any emotional catharsis and probably isn’t meant to. But because investigations both public and private into the GameStop affair remain ongoing, the film more or less peters out in its final moments. The aforementioned testimonials also go on too long, hinting that the Mulligans might have had trouble getting the movie to a feature-length.

Whatever the shortcomings of Apes Together Strong, the Mulligan Brothers deserve applause for their comprehensive breakdown of the forces that led to the GameStop short squeeze and the insight they offer into the events of the scandal. Though they mimic the approach of Adam McKay with their mix of humor and asides designed to explain the complicated forces in play here, the directors avoid McKay’s tendency to go off on needless tangents or use grating humor.

The world of 21st Century investment and finance is a madhouse of corruption, shadowy dealings, and amorality, a behemoth wounded by a group of freedom-minded internet nerds who shed light on a system evermore uncivilized.

Maybe Apes Together Strong is a Planet of the Apes movie after all. You can find out more about the film here.

Apes Together Strong is available to watch on Vimeo, AppleTV and Amazon.

You can view the original article HERE.

.jpeg)